常州市地图,小学生奶粉,成都天气预报一周

Disney Case Study迪士尼案例研究

方案NPV M$IRR%此方案NPV与基本方案差异的可能性

基本情况($2242)-4.91%-

1($2580)-8.64%21.30%(338美元)

2($2557)-8.40%21.30%(315美元)

3($2665)-8.96%21.30%(423美元)

Combi-1(2847美元)-12.34%12%(605美元)

Combi-2(3207美元)-17.75%12%(965美元)

Combi-3(2939美元)-12.86%12%(697美元)

最终($2173.34)-8.78%100%$69

1。查看您的数据和结果

结果的详细信息显示在Excel工作表中。

Scenario NPV M$ IRR% Likelihood of this scenario NPV DIFF from base case

Base Case ($2,242) -4.91% -

1 ($2,580) -8.64% 21.30% ($338)

2 ($2,557) -8.40% 21.30% ($315)

3 ($2,665) -8.96% 21.30% ($423)

Combi-1 ($2,847) -12.34% 12% ($605)

Combi-2 ($3,207) -17.75% 12% ($965)

Combi-3 ($2,939) -12.86% 12% ($697)

FINAL ($2,173.34) -8.78% 100% $69

1. Review your data and results

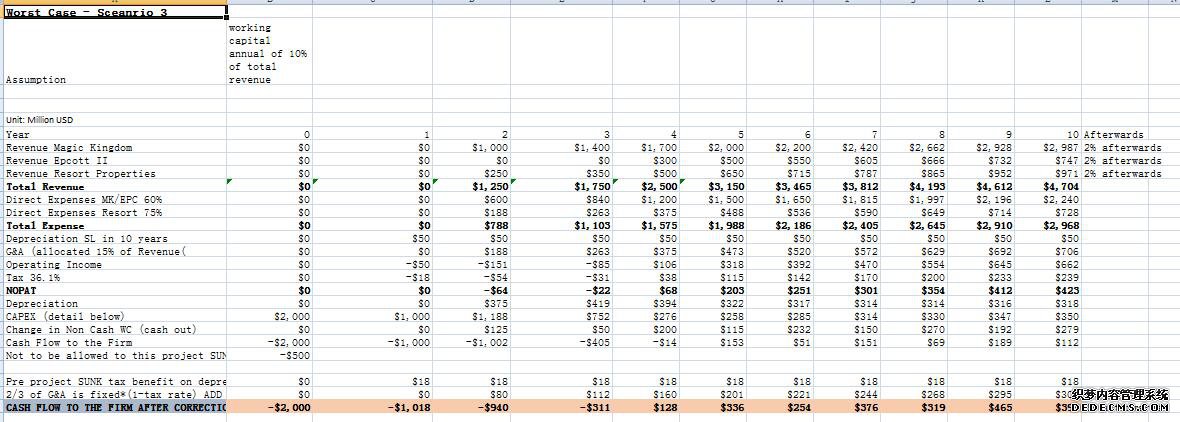

The detail of the result is present in the Excel Sheet.

基本情况,最坏情况1、2、3;最坏情况组合1、2和3。每个场景都有其可能性,这意味着发生的可能性。

每种情况下计算结果的详细信息将在Excel表中引用。

2。就向董事会推荐什么形成意见

项目净现值为负,基本情况和各种最坏情况的内部收益率为负。

三.根据你对每种情况的估计可能性得出最终结论

最后结论请参考上表,净现值为-21.73亿美元,内部收益率为-8.78%。

The Base Case, Worst Cases 1, 2, 3; Worst Cases Combination 1, 2 and 3. Each of the Scenario has its likelihood, meaning the probability of occurrence.

The details of the result calculated in each case would be referred to in the Excel sheet.

2. Form an opinion about what to recommend to the BoD

The NPV of the project is negative, and the IRR% is negative for the Base Case and also for the various Worst Cases.

3. Based on your estimated likelihood of each scenario come to a final conclusion

Please refer to the table above for the Final Conclusion, the NPV = -$2173 million and the IRR = -8.78% overall.

4. Think about “exit-strategies” if this project goes SOUTH

(1) To sell the Theme Park business segments of Disney to other companies. The disposals of such business with less profit making would increase the total revenue of the Group.

(2) To separate out the Theme Park business segments of Disney and make it IPO

(3) To replace the current CEO with a better candidate who would run more the company more efficiently and profitably.

5. What is your contingency-plan?

Having enough insurance covered for the properties, i.e. the theme park, and other entertainment properties and also covered for the employees in the company.

6. How will you manage risks that can be managed?

(1) FX CurrencyRisk Management

To use currency risk instruments like the FX swap or FX forward derivatives between the USD and the Brazilian Real BRL currency pair to mitigate the risk.

(2) Operational Risk Management

• As Disney, being such a big organization with different and diversified business segments individually, risk can be identified, defined and quantified at each individual Business Unit.

• Risk Management strategies and policies can be developed and implemented with the leaders of different business units and being reported to the Management and Board of Directors for review and approval.

(3) Concentration Risk Management

As Disney has a large presence in the United States and the business is running in the single concentrated markets, there is possibility of concentrated business models. As such, concentrated risk management could be mitigated by having more business presence all over the world in different regions.

|